minimum balance required

up to $250,000 by NCUA

to an ATM or debit card at age 13

The financial freedom your teen craves with appropriate supervision from you

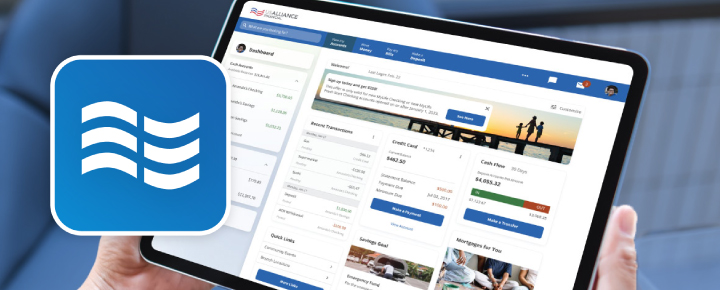

Finances can be tricky if you have a teenager – on the one hand, you want them to learn about handling money, but on the other, you might not feel comfortable giving them no boundaries whatsoever. MyLife Checking for Teens strikes the ideal balance to make it a valuable financial tool for you and your teen. They can check their account balances in digital banking, deposit checks instantly from their mobile device, and start to get comfortable with the ins and outs of operating their own account. They even get access to an ATM or debit card that allows them to withdraw cash from over 33,000 fee-free ATMs or pay with their card. MyLife Checking for Teens has no monthly maintenance fees or minimum balance requirements, so your teen can start from anywhere and not have to worry about money getting drained out of the account by fees.

With all of that comes the ability for you to keep an eye on them and make sure that they stay on track with their finances. While you provide them with some financial freedom and allow them to learn certain financial lessons by doing things themselves, you maintain the critical element of oversight to notice any issues and lend a helping hand to your teen when they need it. Balancing the autonomy with the supervision is essential, as it gives you the peace of mind you need while your teen experiences the freedom they want.

The financial freedom your teen craves with appropriate supervision from you

Finances can be tricky if you have a teenager – on the one hand, you want them to learn about handling money, but on the other, you might not feel comfortable giving them no boundaries whatsoever. MyLife Checking for Teens strikes the ideal balance to make it a valuable financial tool for you and your teen. They can check their account balances in digital banking, deposit checks instantly from their mobile device, and start to get comfortable with the ins and outs of operating their own account. They even get access to an ATM or debit card that allows them to withdraw cash from over 33,000 fee-free ATMs or pay with their card. MyLife Checking for Teens has no monthly maintenance fees or minimum balance requirements, so your teen can start from anywhere and not have to worry about money getting drained out of the account by fees.

With all of that comes the ability for you to keep an eye on them and make sure that they stay on track with their finances. While you provide them with some financial freedom and allow them to learn certain financial lessons by doing things themselves, you maintain the critical element of oversight to notice any issues and lend a helping hand to your teen when they need it. Balancing the autonomy with the supervision is essential, as it gives you the peace of mind you need while your teen experiences the freedom they want.

What our members say:

Never Been More Impressed!

Experience the Cooperative Difference

.webp?width=250&height=212&name=COOP-USALLIANCE-red%20(1).webp)

Member Focused